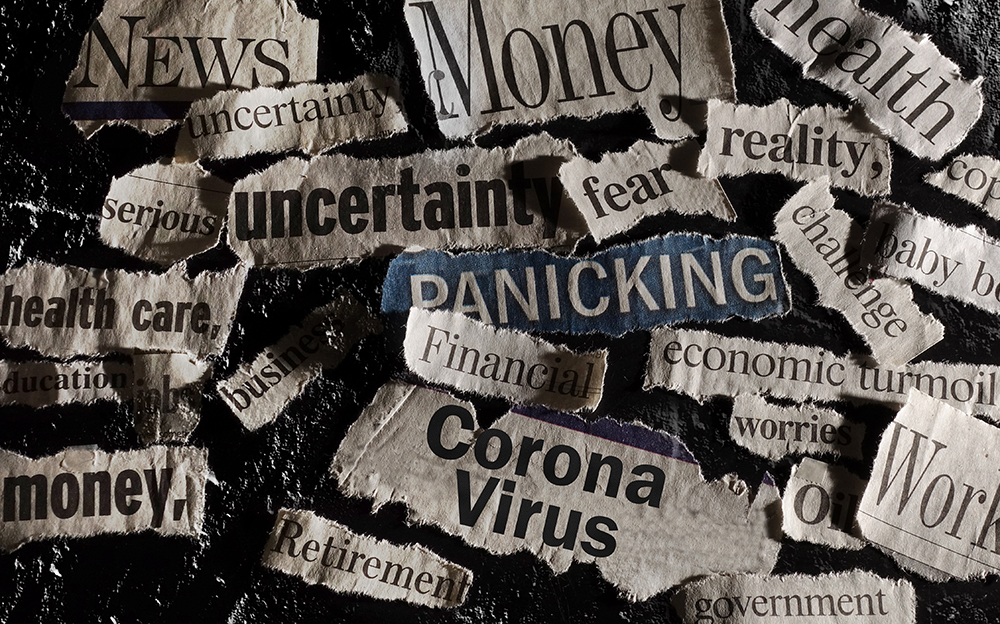

Organise Finances During Covid-19

The Covid-19 pandemic affected each one of us from March 2020, and the impact of Coronavirus continues to do so during 2020. The UK Government put measures into place to try to help us, and keep the economy as stable as possible. However, with the inevitable recession we are now in, household budgets are tight, and we need to save money where we can. An easy way to do that is to organise our finances.

Such measures included the furlough scheme (aka Coronavirus Job Retention Scheme), credit payment holidays, mortgage and renting aid and more. Yet the future is still looking turbulent for the remainder of this year as the furlough scheme and payment holidays are set to end in October, and millions of us worry about financial difficulties with no end in sight of the pandemic.

With that in mind, what can you do to help stretch your money that little bit further?

Look at income and expenditures and plan your budget.

Probably the best starting point in organising your finances is looking at your ingoing’s and outgoings. There’s no time like the present to sit down and work out precisely what comes into your bank account and how you spend that income. Check your bank statement thoroughly to see precisely what leaves your account every month.

The debt charity StepChange has a comprehensive budget planner you can use for free here.

Are there any direct debits leaving your account for services you no longer use? Maybe a gym membership you no longer use, or a streaming service you no longer use? Perhaps you need to consider whether something is essential even if you feel you ‘need’ it.

Once you have looked at exactly what comes in and goes out, it is time to prioritise your debts. Paying your mortgage and credit card is far more important than prioritising a monthly TV streaming package or a new mobile phone.

Non-payment of bills will have an adverse effect on your credit score, so it’s essential to make sure you pay those first and foremost. Although the credit reference agencies have not put mortgage and credit card holidays this year as arrears, this will soon change.

Organise finances – areas you can cut down your spending.

Once you organise your banking into what’s coming in and what you spend it on, you’ll be able to prioritise things to spend your money on. We’ve all got those little things that we know we could cut back on. And those things add

Do you buy a coffee on the way to work, or buy lunch every day? The alternative is to take your own coffee in a travel mug and make your own lunch to take to work with you.

Are there better energy or broadband deals available? If your contract has ended, you are quite likely now paying too much. Shop around to see what else is on offer.

Have you looked at insurance providers? From car insurance, building and contents to life insurance, are you getting the most out of your money? Don’t rely on the fact that your renewal quote will be the best, or that you are rewarded for loyalty, that all too often is not the case.

Also, look into using cashback sites too, such as Topcashback. If you use a retailer through their site, there could be some cashback in it for you! These sites come in handy if you shop a lot online: they may pay out a mere 1%, or it may be a set amount such as £50, but any amount, no matter how small, is better in your pocket!

Swap to a better deal on your mortgage.

Although mortgage deals aren’t as plentiful as before the Coronavirus pandemic, there are still a few out there. Lenders have more concerns about customers defaulting on payments, which is understandable in the current climate, with job losses on a scale that the UK hasn’t seen for a long time. But, that’s not to say that there are better deals available. If you are unsure of how to proceed, find a local, independent financial advisor to help you.

Check any charges on your borrowing.

Most of us utilise one or more lines of credit. For example, this could be a credit card, your overdraft or even a loan. But, are you really getting the best deal?

Competition is rife with the banking institutions, with many offering cashback deals in an attempt to persuade you away from your current service provider. A little bit of research into what is provided can go a long way. Overdraft charges can vary so if you use your overdraft a lot, it is worth finding a better deal for that.

Credit card companies may offer a 0% deal for a set number of months. This is useful if you don’t have a large balance that you know you can pay off in that time frame (and not add to!) to perform a balance transfer. Don’t dismiss those not at 0%; you could still end up paying less than your current APR.

Debt consolidation to organise finances

In some circumstances, consolidating a few small debts into one monthly payment can help, if you are sure you can repay the monthly repayment. Do check if any of your existing loans have ‘redemption penalties’, which is a fee charged by the lender for ‘paying off’ your loan early, which you are effectively doing with the one larger consolidated loan.

As well as the doing this to organise your finances, you also can do this for credit. You need to be careful about what affects your ability to get credit in the future. Paying your bills on time helps, but be cautious on social media, as this can have a significant impact on your future credit. Open a free account with Notty to learn more about your social credit score.

If money problems are beginning to overwhelm you, there are institutions and charities in England, Wales and Scotland, that can help and offer advice.

Money Advice Service. This link will take you to their Coronavirus Money Guidance Hub.

StepChange.org also has a dedicated Coronavirus section.

Citizens Advice offer great help and can point you in the right direction.

Gov.uk offers guidance and support for any queries.